Are you confronted with a mountain of debt that feels impossible to conquer? You're not alone. Many individuals find themselves burdened by increasing financial obligations. But there is light at the end of the tunnel. Expert resolution services can provide the guidance you need to take control.

- Professional debt consolidation specialists work with you to design a personalized plan that meets your unique circumstances.

- They can help you negotiate your debts, explore options for debt relief, and build your credit score over time.

Reach out today to explore how expert resolution services can transform your financial future. You have the right to a life free from the stress of debt.

Consolidate Your Debts and Simplify Payments

Drowning in various debt can feel daunting. Luckily, there's a solution that can help: debt consolidation. This entails taking out unified loan to pay off multiple existing debts. By consolidating your payments into one sole payment, you can potentially reduce your overall interest rate and make managing your finances noticeably simpler.

- Consider a debt consolidation loan if your current loans are causing you difficulty.

- Speak with lending institutions to determine which debt consolidation strategy is most appropriate for your circumstances.

- Research different lenders and interest rates to find the most favorable deal.

Settle Lower Payments with Our Debt Settlement Experts

Are you struggling under the strain of overwhelming debt? Our expert team is here to guide you through the process of minimizing your payments and regaining control of your finances. We'll negotiate with your creditors on your behalf to secure a mutually beneficial settlement that fits your budget. Let us help you achieve financial relief.

- We have years of experience in the debt settlement industry.

- Our dedicated team will work tirelessly to achieve the best possible outcome for you.

- We offer honest communication throughout the entire process.

Cease Debt Collectors: Dispute Unfair Charges

Are you being harassed by debt collectors who seem to be out of control? Know your rights and resist back against these unfair practices. Don't just permit them exploit you. If you suspect that the sums they are claiming are unfounded, it is your right to dispute these charges. A sound dispute can often halt their actions.

- Initiate by reviewing your credit report for any errors or inaccuracies.

- Contact the debt collector in writing and clearly state your dispute.

- Maintain detailed records of all communication with the debt collector.

Achieve Financial Freedom Through Debt Relief

Escaping the bondage of debt is a crucial step towards achieving financial freedom. A burgeoning number of individuals find themselves strapped by debt, often leading to stress. However, there are practical strategies available to help you shed your debt and embark on the path to financial security. One such strategy is seeking professional counseling from reputable debt relief organizations. These organizations can analyze your financial situation and develop a personalized plan to help you reduce your debt effectively.

There are various types of debt relief programs available, each with its own advantages. Some popular options include debt consolidation. It is important to meticulously investigate your options and opt for a program that best aligns with your circumstances.

- Remember that debt relief is not a quick fix. It requires dedication and a willingness to make changes.

- Stay persistent throughout the process, as it may take time to see results.

- Ultimately, achieving financial freedom through debt relief is a fulfilling journey. By assuming responsibility of your finances and utilizing effective strategies, you can break free from the constraints of debt and establish a secure and prosperous future.

Get Out of Debt Faster with Strategic Consolidation Plans

Are you feeling overwhelmed by clumps of debt? It can be tough to stay afloat when you're juggling multiple payments and high interest rates. Fortunately, there are strategic strategies like debt consolidation that can streamline your journey to financial freedom. Consolidation involves combining your debts into one unified payment with reduced interest rate, making it more manageable to stay on top of your finances.

- Researching various consolidation methods can help you discover the ideal solution for your unique needs.

- Collaborating with a reputable financial advisor can provide valuable guidance throughout the process.

Remember, getting out of debt is a marathon, and consistency is key. By implementing a strategic consolidation plan, you can reduce stress and move closer to your financial goals.

Struggling with Debt? Made Easy: A Step-by-Step Guide

Feeling overburdened about your growing debt can be devastating. But don't fret! There are effective strategies to manage your financial situation. Our easy-to-follow guide will walk you through each phase of the debt resolution process, assisting you to achieve stability.

- Assess your current money situation. Make a record of all your credit card balances, including the APR, minimum payments, and total owed.

- Formulate a financial roadmap that monitors your earnings and costs. Identify areas where you can reduce spending and allocate more resources towards debt settlement.

- Explore different debt resolution options, such as debt consolidation loans. Speak with a debt expert to determine the best approach for your specific needs.

- Discuss with your creditors to decrease your APR or monthly payments. Share a viable repayment plan and show your dedication to settle your debt.

- Remain consistent with your debt repayment plan. Review your development regularly and tweak as needed to stay on track.

Say Goodbye to Stress: You Handle Your Debt Negotiation

Are you drowning in a sea of debt? Feeling overwhelmed and stressed by mounting bills? Take back control of your finances with our expert debt negotiation services. We will work tirelessly to minimize your debt, allowing you to gain peace of mind.

- Stop worrying

- Take charge of your debt

- Receive tailored strategies

Allow us to handle the complex world of debt negotiation while you focus on what matters most. Schedule your appointment and take the first step towards a brighter financial future.

Find Lasting Peace of Mind with Debt Management Solutions

Are you constantly stressed about your Credit Card Debt outstanding balances? Do you feel like your financial situation is dictating your life? Gaining lasting peace of mind starts with effective debt management solutions.

- Reducing your debt can release valuable time and funds that you can invest to the things that truly count.

- Specialized debt management specialists can help you formulate a personalized plan to efficiently reduce your debts.

- Taking control of your finances today can lead to a brighter, more secure tomorrow.

Mastering Your Finances

Overcoming financial challenges can feel overwhelming, but with the right guidance, you can proactively navigate these obstacles. Leverage expert advice from consultants who can analyze your current situation and create a tailored plan to reach your financial goals. Utilize budgeting tools and techniques to manage your income and expenses.

It's also crucial to build an emergency fund to cope with unexpected financial challenges. Keep in mind that persistent effort and a proactive approach can lead to long-term financial well-being.

Break Free from Debt: Start Fresh Today

Feeling overwhelmed by financial obligations? It's time to turn things around. Simply let debt dictate your life. There are effective strategies to reduce your financial burden and begin a brighter future.

- Research debt consolidation options to simplify your payments.

- Create a realistic budget that tracks your income and expenses.

- Consult professional financial advice from a trusted advisor.

Don't forget, you are not alone. Millions of people have successfully dealt with debt and achieved financial freedom. Today is the day to reclaim your financial well-being.

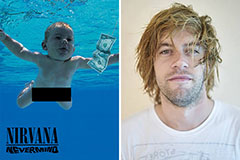

Spencer Elden Then & Now!

Spencer Elden Then & Now! Ben Savage Then & Now!

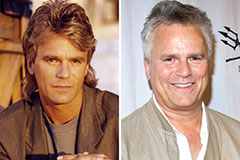

Ben Savage Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!